Is retirement sneaking up on you? I don’t know about you, but when I was in my 20s, planning for retirement seemed very much like a “future Lisa” problem – even though I knew the benefits ‘inside out’ from my career in financial services.

I have daily conversations about retirement with clients, whether they are 30 years away or just around the corner. I assist them in finding the right balance between paying off debt, investing, and contributing to superannuation. In some cases, I’ve even helped clients bring their retirement forward by several years. Over time, I’ve learned what you should focus on, whether you’re 20, 10, or just 5 years away from retirement.

No matter the age of my clients, I always emphasise that superannuation is the most tax-effective environment we have in Australia. For clients with high incomes, superannuation is a key part of their retirement plan almost 100% of the time.

20 Years: Focus on Growth

With 20 years until retirement, you have a long investment horizon, which means you can take advantage of compound growth. Invest in growth-oriented assets like stocks and diversified funds. Regular contributions to your superannuation and taking advantage of any employer matching programs are crucial at this stage.

- Risk Tolerance: You can afford to take more risks with your investments because you have time to recover from market fluctuations. Consider a higher allocation to equities and growth funds.

10 Years Out: Shift to Balance

Ten years out, it’s time to start balancing growth with security. Gradually shift some of your investments from high-risk assets to more stable ones like bonds and dividend-paying stocks.

- Maximise Contributions: Increase your superannuation contributions if possible. Take advantage of any catch-up contributions from previous years allowed by the ATO to boost your retirement savings.

- Debt Reduction: Start focusing on reducing high-interest debt. Paying off your mortgage or other significant debts can free up more of your income for savings and investments, and obviously reduce the amount of overall interest on the debt.

5 Years Out: Emphasise Security

With only five years until retirement, protecting your nest egg becomes the priority. Shift a larger portion of your portfolio to low-risk investments like fixed-income securities and cash equivalents.

- Retirement Budgeting: Create a detailed retirement budget to understand your expected expenses. This will help you decide if your savings are on track to meet your needs. Plan for withdrawals and consider larger expenditures such as cars, caravans, and overseas trips. A financial advisor can optimise your withdrawal plan for tax efficiency and longevity.

The Impact of Salary Sacrifice

For those of you who are not familiar with salary sacrificing, it involves redirecting a portion of your pre-tax salary to your super fund where it is taxed at the super tax rate of 15% as opposed to your marginal tax rate.

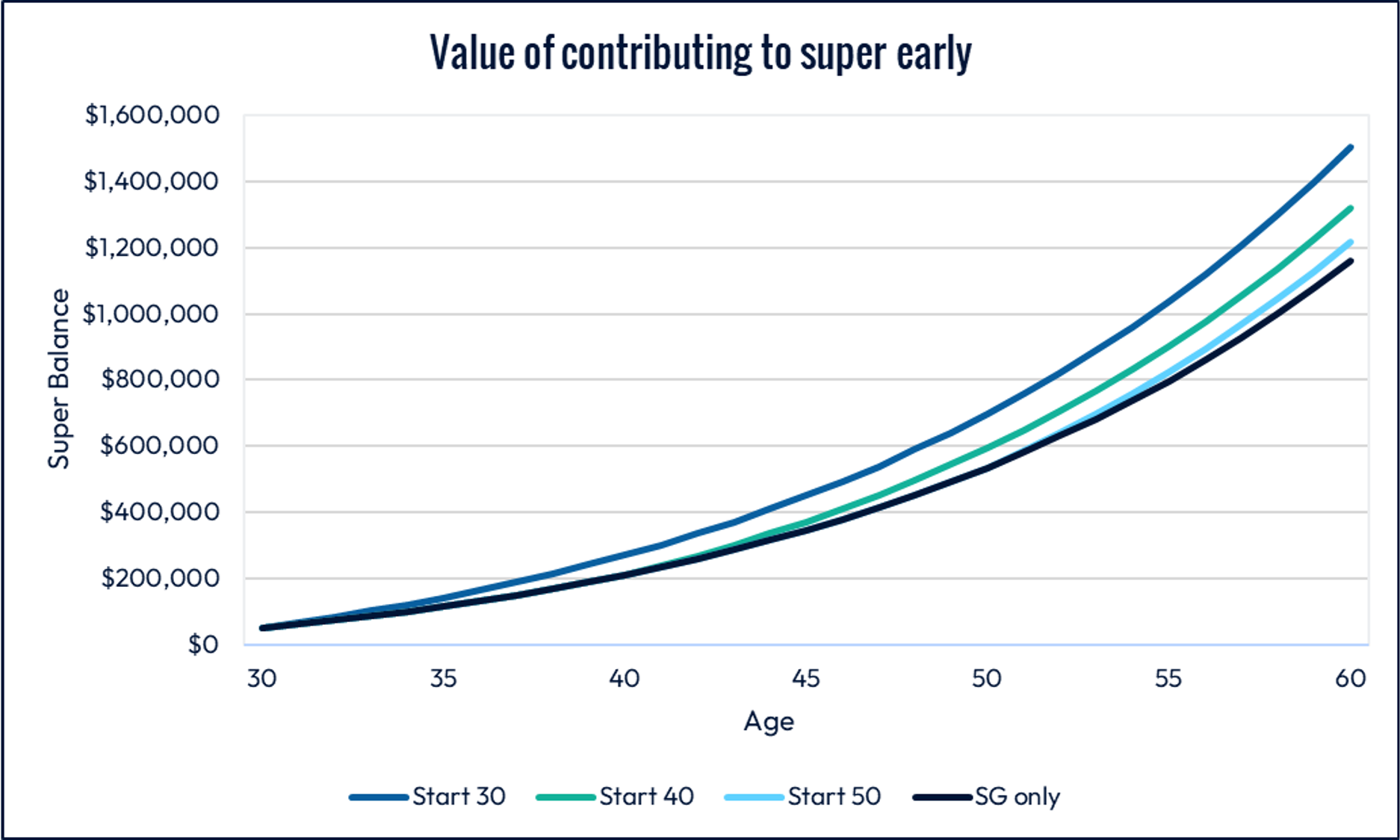

Let’s look at the impact of salary sacrifice on superannuation balances using some basic projections.

Sam is 30, earning $80,000 with a super balance of $50,000, and is currently only receiving her employer’s mandatory super guarantee contributions.

In isolation, here’s how salary sacrificing $100 per week (which equates to a reduction of $68 of your take-home pay) until age 60 can make a difference, depending on the age you start:

Assumptions: Annual earnings forecast at 2.93% growth and 3.41% income (29.6% franked). Salary indexed at 3%. Salary sacrifice amount constant throughout the projection period.

- Salary sacrificing, Sam who started at 30 is $59,255 ahead in her super at 40, $162,958 at 50, and $344,451 at 60.

- Starting at 40, Sam is $59,255 ahead at 50 and $162,958 at 60.

- Starting at age 50, she has got $59,254 more super at 60.

While this demonstrates a static number over time, the availability of surplus cash to allocate to super changes over time.

In your 30s, priorities are more likely to be buying or upgrading your home, Sam may have time off work to raise a family etc., combined with the 30+ year wait to access, Sam is likely less willing to put significant amounts into super.

In her 40s, she is earning more, the mortgage is under control, and she has more surplus cash to allocate.

In her 50s, planning for retirement is high on the priority list and accessing it is within reach. Her mortgage is minimal, and kids are becoming independent and costing less (one hopes).

As you can see, there is power in starting voluntary contributions early. Small actions, over time, can make a significant difference.

Regular Reviews and Adjustments

Retirement can have many unexpected twists and turns, such as market volatility or health issues. Engaging a financial advisor offers the benefit of personalised advice tailored to your unique situation and goals. At Fuse, we work with clients on strategies for debt reduction, investment growth, and retirement planning – ensuring you have a comprehensive plan.

Feel free to book a discovery call if you would like to chat about your specific circumstances.