With 2023 done and dusted, it’s time we turn our attention to navigating the financial waters of 2024, and for may investors there is one big question on their mind… What are the best investments for passive income in 2024? Well, grab a comfy seat, because we’re diving into the best options, complete with juicy details and some real-life numbers.

Before we get into the details though, let’s do a quick recap of the last few years to set the scene….

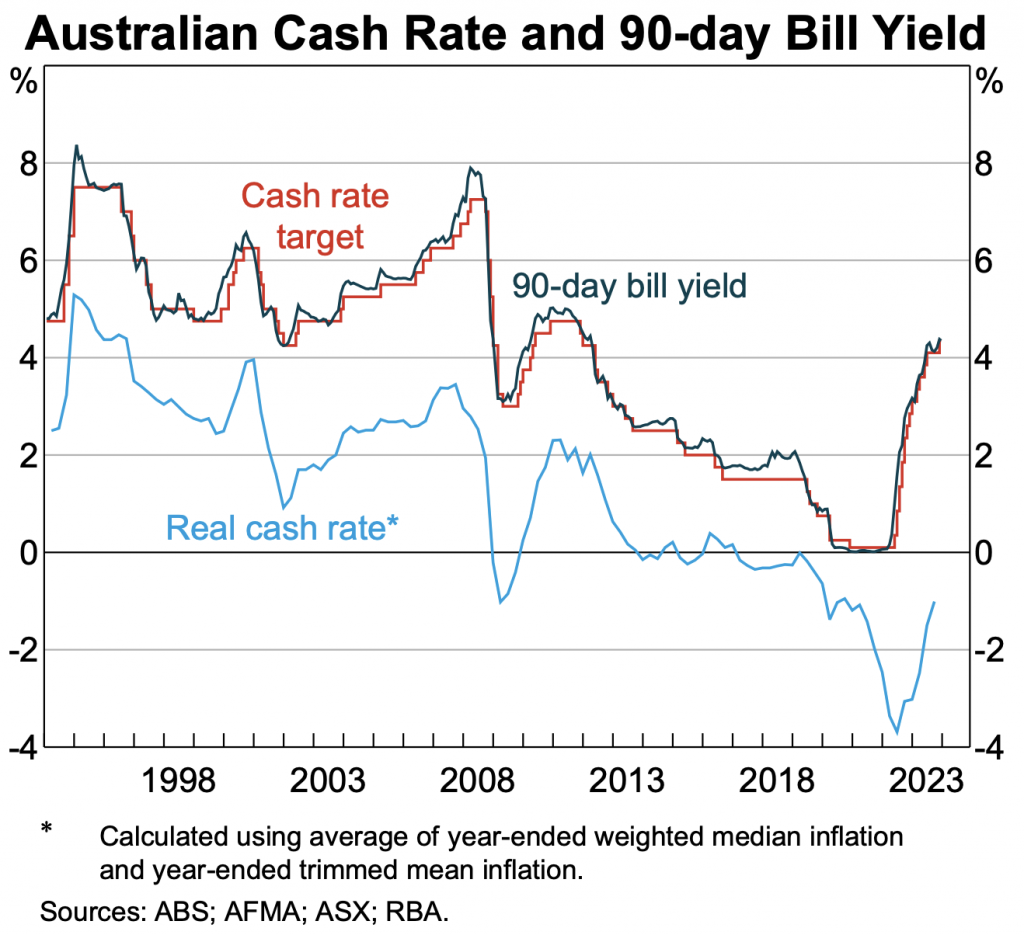

When we’re talking about the best investments for passive income, there is one all important data point that influences the income yields of all asset classes – the cash rate set by a country’s Central Bank, in our case the Reserve Bank of Australia (RBA). Central Bank interest rates are like gravity, and they exert a massive force on both asset values, and the income yields that assets generate.

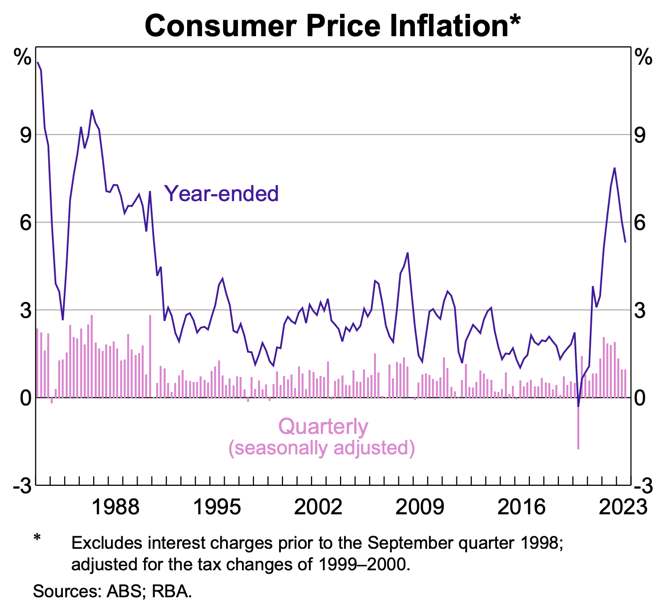

What the chart below shows is that interest rates have been on a steady decline since the early 90’s, falling all the way down to 0.10% during the Covid 19 Pandemic. This has meant that income investors who used to enjoy great returns from their cash and term deposits have been gradually been receiving lower and lower returns over time – until things reversed in spectacular fashion in 2022, when interest rates screamed north at the fastest rate in history.

Whilst those same income investors may be jumping for joy at the thought of 5.00% term deposits, let’s not get too excited just yet…. the most important line on the chart below is the blue line, which shows the “Real Cash Rate” – that is the Cash Rate minus Inflation (CPI). What it shows is that after adjusting for inflation, investors have not been making a return on their cash holdings since 2013!

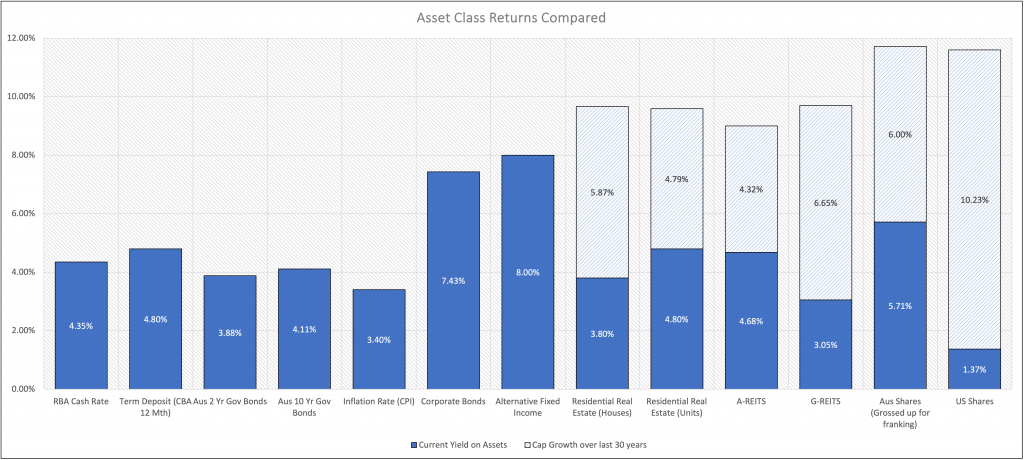

So, if you can’t get a “real return” by Investing your money in the bank, what are the best investments for passive income?

Well, a cursory glance at the chart above gives you plenty of great options, but of course each comes with it own trade-offs, considerations, pros, and cons. We won’t get into each of them in detail this article, but be sure to keep your eyes peeled for Part II, where we’ll do a deep dive into each asset class. For now, let’s look at a few of the important considerations when building a portfolio of income generating assets.

Defining Income Yield

When we talk about yields, we’re talking about the annual income generated, divided by the value of the asset. For example, on a rental property worth $800,000, getting rent of $650.00 p.w ($33,800 p.a) is equal to a yield of $33,800 / $800,000 = 4.25%.

Another extremely important concept to grasp is that yields and asset prices move inversely to one another. When yields go up, it might be because asset prices have fallen, and when yields go down, it might be because asset prices have rocketed higher. Using our example, from above if the property value fell to $700,000 and the rent stayed the same, the yield would increase to 4.82%. If there was a year or two of insane growth (like the post Covid boom for example) and the property value reached $1,000,000 then the yield would fall to 3.38%.

The relationship between yields and asset prices is a little like a chicken & egg scenario – did the change in income impact the price, or did a change in the price impact the yield? That little riddle is nuanced and the answer differs a bit between asset classes, but the general principal is the same – yields and asset prices move opposite to each other.

All Income is Not Created Equal

When looking for the best investments for passive income, its important to consider that not all income is created equal! What do i mean by that? Well let’s use a comparison between Residential property and Australian shares.

Residential property income:

The income yields on our chart above are the gross income generated. Now unfortunately before you get to spend any of it, you need to cover some costs which are generally going to subtract 1.0% – 1.5% from your yield. Make sure you consider the following costs, so you can work out your net yield, and do a like-for-like comparison.

- Rates

- Water

- Landlord Insurance

- Maintenance

- Annual smoke alarm tests

- Management fees

- Interest, if you don’t own the property outright

- Leasing fees if you lose a tenant

- Time unrented between tenants

- Tax on your income if you are positively geared (which you should be if your goals is passive income)

Income from Australian Shares:

The income from Australian shares however is very different as a result of our dividend imputation system (Franking Credits). Income from shares is referred to as a dividend, which is simply a payout of the company’s profits to its shareholders… but that’s not all that gets paid out. Dividends are usually paid our AFTER the company has paid tax on its profits, so when a company pays you a dividend, it also gives you a credit for the tax it has already paid on your behalf. This is referred to as a franking credit. When we include the value of the franking credit in the calculation, this gets referred to as the “grossed up yield”, and provides a like-for-like comparison with the gross yield from residential property (or any of the other asset classes in our chart above).

How passive is it… really?

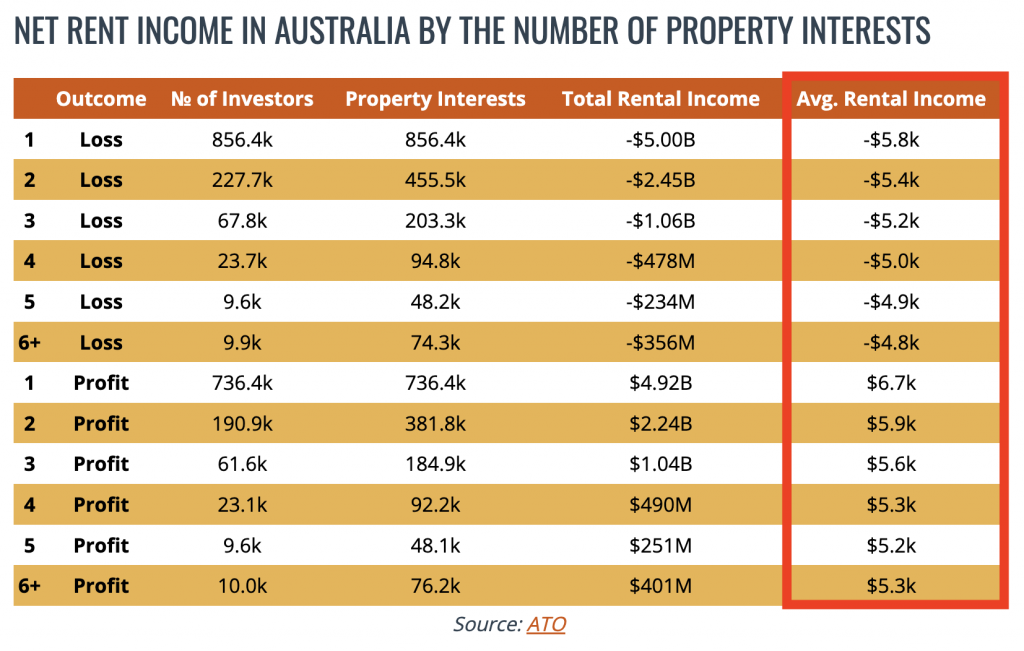

Early on in their investment journey, many investors dream of buying an investment property, then using the equity to leverage into a second… then a third… then a forth, ultimately building a grand property portfolio that delivers mountains of “passive income”. The reality is that things get a whole lot tougher after the second property – and it shows up in ATO data.

The latest data from the Australian Taxation Office (ATO) reveals that 2,245,539 Australians or around 20% of Australia’s 11.4 million taxpayers owned an investment property in 2020-21 – this is the latest data available at the time of writing and was released in June 2023.

Here’s what the data had to say.

- 71.48% of property investors hold 1 investment property

- 18.86% of property investors hold 2 investment properties

- 5.81% of property investors own 3 investment properties

- 2.11% of property investors own 4 investment properties

- 0.87% of property investors own 5 investment properties

- 0.89% (or 19,920) of property investors hold 6 or more investment properties

That means that of all Investment property owners, 90% had only 1 – 2 properties.

Interestingly, what the data also revealed is that 54% of all Investment Properties in 2019 – 2020 tax year were negatively geared (lost money), and of the ones that were positively geared, the average rental income was a long way funding a dignified retirement.

So whilst it may be possible for 0.89% of property investors to amass a portfolio of 6 or more properties that combined might generate enough passive income to fund their lifestyle, the reality is that it is exceptionally rare. Most investors that i meet find it difficult to grow a large portfolio due to an inability to service the loan interest required, and even if they do manage to obtain 3 or 4, most investors discover that owning a property portfolio is anything but passive…. it can become a full-time job!

On the other hand, investments such as Cash, Term deposits, Shares, and Real Estate Investment Trust (REITS) can deliver truly passive income – you can just sit back and watch the $ roll in without the stress of tenants, repairs and maintenance, mortgages, insurance etc. Make sure you match your investments with not just the yield you need – but how hard you’re prepared to work for it!

Balancing Risk and Reward

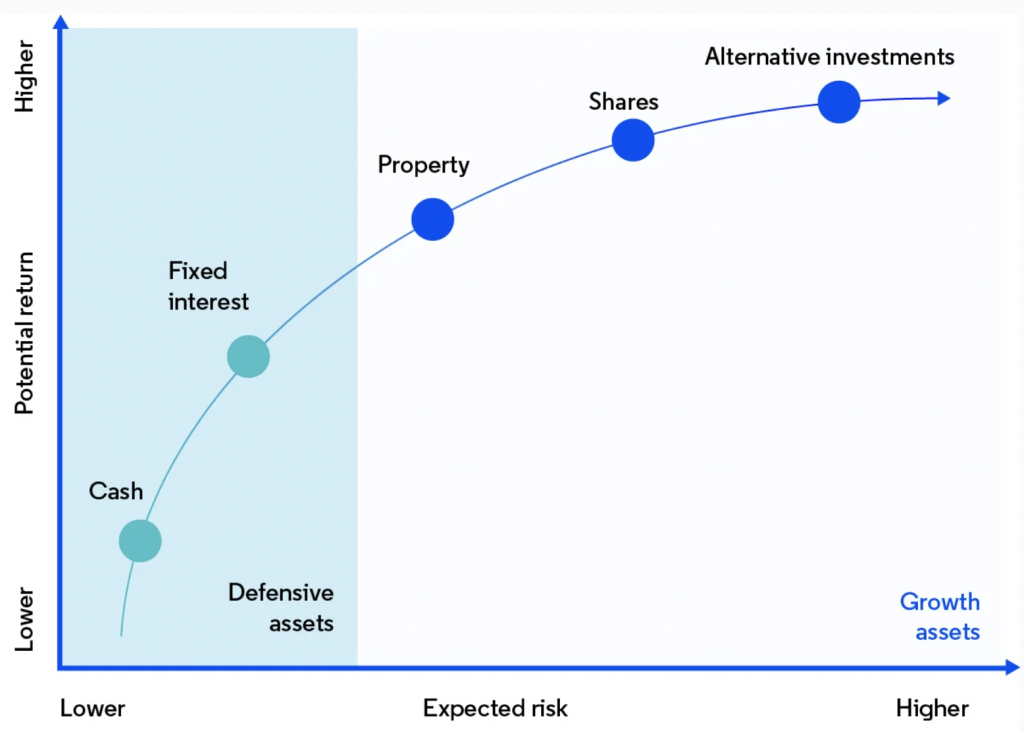

Risk and Reward are two sides of the same coin, and its really important to consider them both when you’re looking to maximise your passive income. The chart below shows that if you want to generate higher returns, you’ll also need to hold assets that are further and further to the right…. and get comfortable with the increased risk that they come with.

Source: https://moneysmart.gov.au/

What is not on the chart is the myriad of sub-asset classes that exist within each asset class. For example, “Fixed Interest” could be relatively risk-free term deposits, government bonds, more risky higher yielding corporate bonds, or even unlisted alternative fixed interest investments. The reality is that if want a return that is higher than a cash-at-call savings account, you will be taking on some form of risk. Even term deposits carry to the risk the risks that a) you can’t access your cash for the agreed term, and b) if interest rates go up while you’re locked in, you could have got a better return from remaining in a savings account.

If you see really attractive headline yields (like the corporate bonds and alternative fixed income assets in the first chart) it’s time to start asking questions. It might be that the risks are acceptable, or can be mitigated, but don’t get sucked into thinking that just because it pays a high level of monthly interest that it’s a safe investment. The only things truly “safe” is a bank account (though it’s the riskiest investment in the long-term as your money simply won’t grow ahead of inflation).

We are constantly assessing the underlying risks of our clients investments to ensure that yields are maximised, total returns deliver against expectations, and that risks are managed effectively.

Liquidity Matters:

Liquidity refers to the ability to turn an investment back into cash (or vice versa) efficiently, without causing major changes in the price of the asset.

It’s a massively under-appreciated investment risk, but it is so important to consider when building your passive income portfolio. Life changes, and sometimes the best laid plans of mice and men need to to be adjusted. And when they do, it’s not uncommon that it is due to a life event that is unexpected, urgent, and stressful. Make sure you’re ready for whatever life throws at you by considering the liquidity of your investments – its not easy, or cheap to turn a a house, a commercial property, an unlisted property trust, private loans, or other similar investments back into cash in a hurry!

For a deeper dive on why liquidity matters you might want to check out an article i wrote in the midst of the CV19 pandemic – when liquidity totally dried up and cause some of the most wild market moved i have ever experienced.

So, there you have it – a brief intro into some of the investment options for generating passive income in 2024. Before you go hell for leather throwing your heard earned $ into any old option, make sure you consider risk vs reward, liquidity, tax implications, and my favourite consideration for our “Whiskys” (Retiree investors who are getting better with age), the “effort to reward ratio”, or “return on hassle” (more about that in a future article).

Keep your eyes peeled for Part II in the coming weeks, where we’ll have a closer look at the asset classes that can help form part of a bullet-proof income portfolio to help you live your best life in retirement! If you’re not getting the income you need out of your investments, get in touch for a chat with our Financial Advisers Saul and Lisa who can help you get the most out of your assets, so you can get the most out of life! We look forward to seeing you soon.